It is no mystery that as a business continues to grow, the need for outside services becomes more and more of a reality. This is where many of the advantages of payroll outsourcing comes into play. While many businesses make attempts at conducting payroll services in-house, they are quickly learning why this could be better handled through outsourcing services. How? Once companies remove in-house services, they undoubtedly save time and money. You can save a significant amount of money through using outsourcing services, thus increasing profit.

Tags: payroll companies, payroll service, payroll companies in California, payroll companies in Arizona, payroll companies in Nevada, Payroll company, HR Allen Consulting Services, Payroll Outsourcing, payroll, outsourcing payroll

You’re looking for that key staff member who can take your business to the next level. You’ve tried the mega job boards, but the candidates who’ve applied aren’t remotely qualified for the position — and you’re tired of weeding through your inbox. Should you turn to an employment agency? Maybe. Consider these factors before you do.

- Industry-specific recruiters know where to find qualified candidates. Experienced headhunters working within a particular industry generally understand its key players and where to promote open positions. Often, they contact employees of competing firms to see whether they’re interested in a job, which is probably not a tactic you’d dare to try on your own.

- Anyone can call himself a recruiter. Unlike for lawyers and real estate agents, there are no licensing requirements for recruiters. When considering using a headhunter, pay close attention to his prior experience and clients. Ask for referrals to make sure that he’s made good matches in the past.

- Recruiters are motivated to find employees fast. Because a recruiter isn’t paid until she matches a job seeker with a job, she’s eager to find you a candidate quickly. This can be a good for you if she’s careful to vet the candidate’s qualifications; however, if she rushes to fill the job for the sake of getting paid, you may not end up with the ideal person.

- Recruiters may rule out candidates you’d like to hire. When you give recruiters a set of criteria, they tend to make sure that all potential candidates fulfill everything on your wish list. That means they’re likely to rule out any candidate that’s even slightly lacking, but whom you may have liked despite the fact that they weren’t the whole package. Make sure to clarify details such as whether you will accept relevant experience in related industries or might allow telecommuting for the right candidate.

- Recruiter fees can drive down employee salaries, shrinking your pool of potentialemployees. Although you don’t pay anything out of pocket to use an employment agency, you’ll need to budget its fee (typically, around 20 percent of the candidate’s salary) into the amount you’re paying for the hiring package. That means that if your dream hire asks for an extra $10,000 in salary, you may not have room to negotiate — and could end up losing the candidate as a result.

- Recruiters can save you time. By outsourcing the application review and interviewing process, you’ll free up your time to focus on more profitable business ventures. Although you’ll have the final say in hiring a candidate, all of the time-consuming work that goes into making that decision will be handled by someone else.

Tags: Recruiting, recruiters, employees, employee, Hiring

The minimum wage in San Francisco will increase to $10.24 per hour, effective January 1, 2012:

Tags: employees, Employers, Minimum Wage, Compensation

On Thursday the Senate voted 95-0 in favor of legislation that would provide employers with tax credits for hiring long-term unemployed and wounded veterans. These benefits were approved as an amendment (S. Amdt. 927) (pdf) to the 3% Withholding Repeal and Job Creation Act (H.R. 674) that the House of Representatives cleared in October. Introduced by Sen. Jon Tester (D-MT), the VOW to Hire Heroes Act of 2011 amendment would provide employers with a “Returning Heroes” tax credit of up to $5,600 for hiring veterans who have been unemployed for at least six months, a $2,400 credit for hiring veterans who have been unemployed for more than four weeks, but less than six months, and a credit of up to $9,600 that would increase the existing Wounded Warriors Tax Credit for employers that hire veterans with service-connected disabilities who have been unemployed for at least six months. These credits were initially included in President Obama’s more comprehensive job stimulus bill, the American Jobs Act (S. 1660), which stalled in the Senate last month. The Senate agreed to include the VOW to Hire Heroes amendment to H.R. 674 by a vote of 94-1 before passing the entire measure.

Tags: Employment Taxes, VOW to Hire Heroes Act, Veterans Tax Credit, Employee Benefits

Getting fired doesn’t always involve a dramatic showdown meeting with your boss who tells you to pack your things and get out. In an age where employers are paranoid about getting sued by fired employees, firing an employee is often more complicated, involving many subtle steps. As an employee, it’s up to you to spot these subtle signs before you run out of options. The more lead time you get, the sooner you can engineer a smooth transition into your next position. eWeek.com has an article called 10 Signs Your Company Wants You Gone. It’s worth the read, especially as the jobs market heads deeper into recession.

Tags: fired, firing, terminated, termination

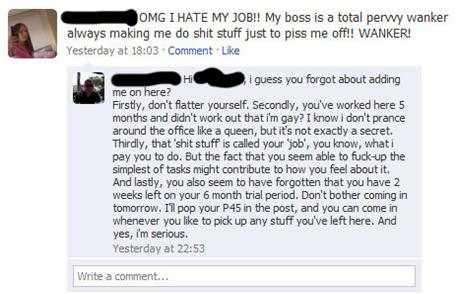

Do you have a personal account with Facebook, MySpace, Twitter or any of the other social media websites that have become so popular lately? Chances are you do. Or you will soon. The growth of social media sites has been nothing short of breathtaking. Here are a few statistics:

Tags: myspace, employee termination, employer, termination, facebook, twitter

Tags: Medical Leave, Tips for Employees, employees, Employers, FMLA, CFRA

Tags: Medical Leave, Tips for Employees, employees, Employers, FMLA, CFRA

Under California law (which is much more generous to employees than federal law), if you are a non-exempt worker, you are entitled to meal and rest breaks: a 30-minute meal break if you work more than 5 hours in a workday, and 10 minutes breaks for every 4 hours you work. There are other requirements though. If your boss doesn’t comply with break requirements, they are required to pay you one extra hour of regular pay for each day on which a break violation occurred.

Tags: rest breaks, california rest breaks, break periods, employees

It’s customary during the holidays to reflect on the past year of our lives and to acknowledge the people who’ve supported us. For small-business owners, this means taking a few minutes out of our busy schedules to give thanks to customers and employees. Here are some suggestions.

Tags: customers, customer appreciation, employees, employee bonus, employee gifts