There comes a time in the life of most successful businesses when a decision has to be made as to whether certain HR tasks are best handled in-house or by an HRO (human resources outsourcer). Making the right call at the right time isn't easy, but certain telltale signs can indicate when it's time to "pull the trigger" and call for help. This is what you should look for:

Michael Allen

Recent Posts

Tags: Human Resource Outsourcing, Outsourcing HR, Outsourcing Human Resources, HR Outsourcing

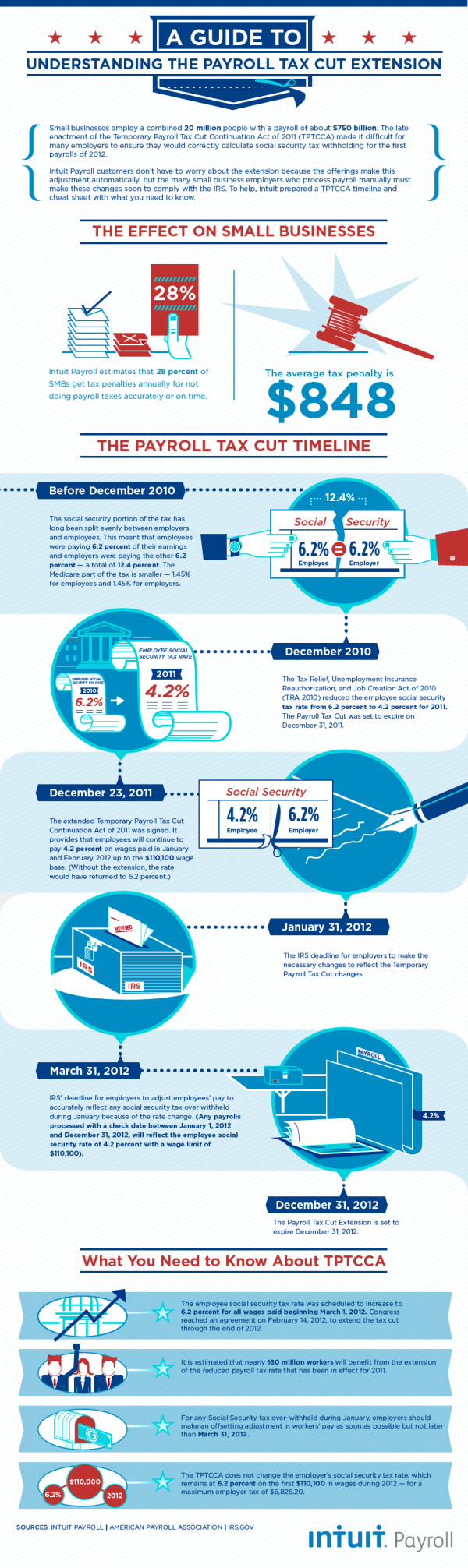

The last-minute enactment of the Temporary Payroll Tax Cut Continuation Act of 2011 (TPTCCA) in December, 011 made it difficult for many employers to ensure they would be able to correctly calculate social security tax withholding for their first payroll runs of 2012. Additionally, the extension of the payroll tax cut last week might leave small business employers wondering about any adjustments they need to make to their employees’ paychecks.

When you’re a big fish in a small pond, recruiting the right people to fill senior-level positions can be a problem. After all, the smaller the town, the smaller the talent pool is to draw from.

Tags: Recruiting, small town, staffing, Hiring

Since January 1, 2012, California employers have paid higher taxes because the state has not repaid money it borrowed from the federal government to pay unemployment insurance (UI) benefits. Unless Congress takes action (which is not expected), the higher tax will remain in effect through 2012 and then increase each year the state has an outstanding loan balance.

California’s UI Trust Fund has been insolvent since 2009.By the end of 2012, the UI Fund deficit is projected to reach $10.7 billion, according to the California Employment Development Department (EDD).

Employers will lose 0.3 percent of their federal tax credit, partially offset by the end of a 0.2 percent surcharge in July 2011.The 0.3 percent tax credit translates into approximately $21 per year for any employee who makes $7,000 or more in 2012. California employers pay UI taxes on the first $7,000 of wages per employee.

Statewide, the tax increase totals an estimated $289.8 million in 2012 and $615.7 million in 2013, according to the EDD October 2011 Unemployment Insurance Fund Forecast. This represents a loss of 0.6 percent of the tax credit in 2012, EDD reports.

The additional taxes paid will help offset California’s federal loan balance.

Tags: California Chamber of Commerce, FUTA, EDD, UI taxes, unemployment taxes, California, California employers, CalChamber

As you might imagine, there’s a new world order here in our house now that there’s a baby at home. He comes first, we come second, and the dogs take whatever they can get. That’s pretty standard, but what happens when you also work at home?

Tags: home office, baby, in the trenches

U.S. Immigration and Customs Enforcement recently began cracking down on employers of illegal immigrants, enforcing steep penalties. During its 2011 fiscal year, the ICE audited the hiring records ofnearly 2,500 businesses to verify workers’ status. Businesses that employ unauthorized workers may be fined and blacklisted from receiving government contracts, and owners may be subject to civil and criminal charges.

Tags: Immigration, I9, I-9

As a small-business owner, you carry a heavy workload, yet there are only so many hours in a day when you can get things done. How can you maximize your productivity?

Tags: organization, Productivity, time management

Earlier, We blogged about how employers and the California Department of Veterans Affairs (CalVet) are working together to educate eligible employees about the federal and state benefits available to military veterans.

Tags: tax credit, veterans, federal tax credit, hire a hero, hiring veterans, state tax credit, employees, Employers, HRCalifornia, CalChamber

A group of California business organizations launched a new website to help California businesses understand their obligations under the dense and complex Patient Protection and Affordable Care Act.

Health Law Guide for Business is designed to provide accurate and easy to understand information on federal health care reform. The website’s motto is “2,409 pages. One simple web site.”

Tags: California Chamber of Commerce, federal law in California, Employers, federal health care reform, small businesses, health care reform

The past two weeks have brought a number of important updates for those watching the Christopher v. SmithKline case, in which the Supreme Court will determine whether pharmaceutical sales representatives are properly classified as exempt from overtime as outside salespersons under the Fair Labor Standards Act (“FLSA”) and whether to defer to the Department of Labor’s (“DOL”) position expressed in amicus briefs that they are not.

Tags: pharmaceutical sales representatives, HR Allen Consulting Services, Department of Labor, exemptions, FLSA